How to claim your federal tax credit for home charging

You might have heard that the federal tax credit for EV charging was reintroduced recently. Here's how to claim your credit for 30% of the cost of your Level 2 AC (240-volt) home charger and installation, up to $1,000.

Use this eligibility location map to confirm whether you qualify for a tax credit on your new charger.

We think ChargePoint Home Flex is a great choice because it charges up to nine times faster than a wall outlet (adding up to 37 miles of range per hour) and is future-ready for your next car and home. It's also ENERGY STAR certified for efficiency and UL Listed for safety.

Request a quote from our network of trusted installers or find an electrician on your own. Another advantage of ChargePoint Home Flex is that the amperage can be adjusted to match your home's electrical supply, which may keep your installation costs down.

Make sure to save your receipt when you purchase the station and get an invoice from your electrician for the installation.

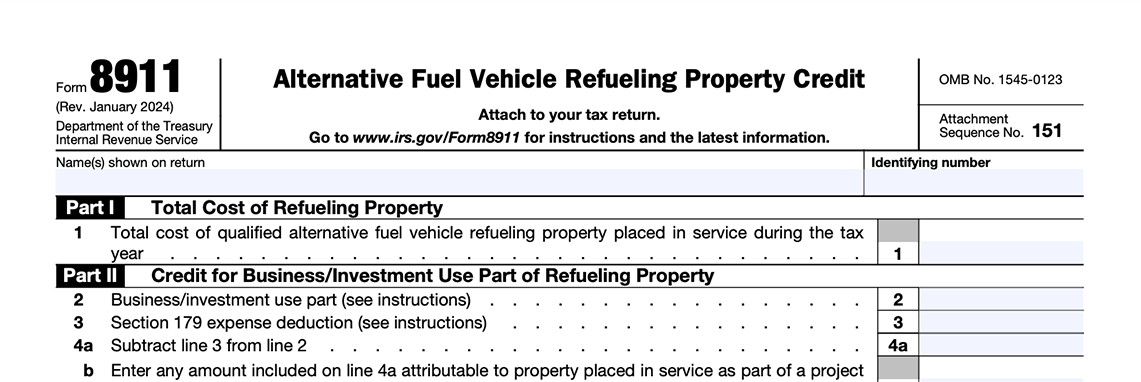

Complete your full tax return, then fill in form 8911. You'll need to know your tax liability to calculate the credit. We're EV charging pros, not CPAs, so we recommend getting advice from a tax professional.

Tip: Keep in mind that you need to have a tax liability (in other words, you need to owe taxes) in order to claim a tax credit. If you are expecting a refund, the refund will not increase due to this credit.

Submit your tax forms along with documentation of what you spent on your charger and installation. Your tax liability will be lowered by the credit you qualify for. Free money!

Ready to get started?

*The content of this notice is provided for informational purposes only and is not intended as tax advice. ChargePoint cannot guarantee that you will be eligible for the tax credit and is not responsible for any issues that may result from your application for the tax credit, including your failure to receive the tax credit. You should consult your tax professional regarding your eligibility for the tax credit.